Dataloft's January 2024 Housing Market Outlook with our Real Estate Economist, Julia Middleton, introduced by Rebecca Gill from the Dataloft by PriceHubble team.

Key take-outs

There are reasons to be cautiously optimistic for 2024. In particular, transaction activity should improve this year on 2023’s weaker levels.

Interest rates, in terms of the Bank of England bank rate, are expected to have peaked. Lower rates expected in second half of 2024 (consensus forecast of 4.7% by Q4 2024).

Longer term interest rates, off which fixed mortgage rates are priced, are already lower. Mortgage lenders are looking to increase lending volumes.

Residential prices were resilient in 2023, only falling marginally and expected to be largely stable over 2024.

Transaction activity expected to pick up over the course of the year as confidence tentatively starts to return to the market.

Rental growth has been unusually high over the last few years and while rents are expected to increase further, the forecast is for lower growth rates over 2024 and beyond.

There is likely to be some continued volatility in residential and economic data; some months will be better and some worse.

We track the market from national level to postcode sector for our clients every day and have a range of data solutions. To access this insight 24/7, and share branded outputs with your clients, let’s chat.

Access the UK’s most rigorous source of residential property market insight

Our subscription platform provides robust property market insight to inform investment decisions and power marketing campaigns. We are trusted across the property industry by estate agents, developers, investors and policy-makers.

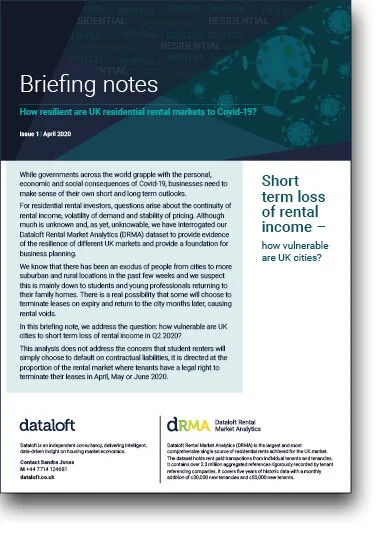

Thought leadership

For further information on Briefing notes contact Sandra Jones

sandra@dataloft.co.uk