Sharing, collaborating and connecting are central to the sharing economy and with that come expectations of ‘on-demand’ standards of service.

CLIENT

Lyvly, in conjunction with SAY Property Consulting

Project

Publications

SKILLS

Desk research

Dataloft analysis

Insight

Visualisation

Design

PR content

This study of London’s sharer market was commissioned by Lyvly, and undertaken in conjunction with SAY Property Consulting. The research findings called into question some commonly-held beliefs about sharers in the private rental sector. Lyvly has an operational platform designed for sharers to create engaged communities and address some of the key challenges of sharing for both tenants and landlords.

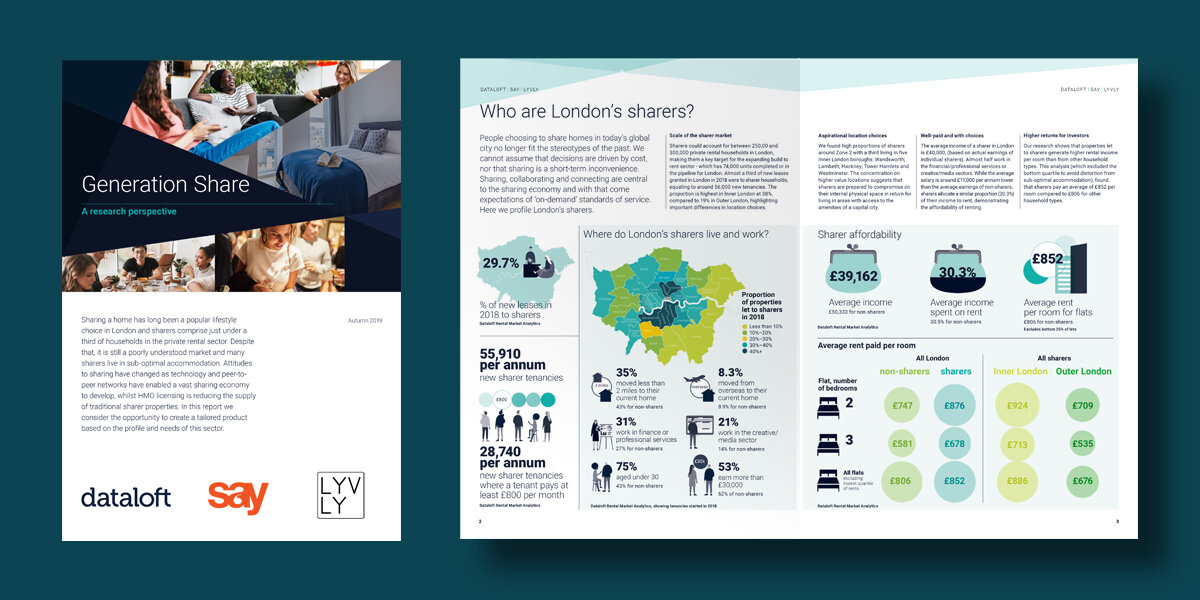

Almost one third of new leases in London are taken by groups of sharers. In some parts of the city, it is as high as 40%. With around 300,000 sharer households and some 150,000 new sharer tenancies signed in any given year, sharers are undoubtedly a major force in the rental market and a demographic that any provider of homes for rent should get to know.

The research study drew on evidence from DRMA, Dataloft’s vast databank of rents paid and tenant profiles. It showed that sharer households are more concentrated in Inner London, begging the question, what do providers need to do to tempt renters to zones 3, 4 and beyond? It also showed that sharers are relatively footloose and mobile, compared to other renters.

Perhaps most surprising was the analysis of sharer income levels. 52% of sharers in the DRMA dataset earn over £30,000 pa, 29% earn over £40,000 and 18% over £50,000 pa.

Presented at a UKAA Roundtable, December 3rd 2019.

Read a write-up of this event in our news section.