Dataloft Briefing notes address issues raised by our clients as they respond to changing housing market conditions through and beyond Covid-19.

Issue 3: Short term loss of overseas students – how vulnerable are UK rental markets?

Short term loss of overseas students – how vulnerable are UK rental markets?

In this series of Briefing Notes we consider aspects of the UK rental markets which look vulnerable in the Covid-19 pandemic. One very likely consequence is a reduction in the number of overseas students taking up places at UK universities in the 2020/21 academic year. There are 450,000 international full-time students in UK universities, just over 24% of all students. A little under a third of full-time and sandwich year students live in the mainstream private rental sector. This means that as many as 130,000 overseas renters could be lost from the private rental sector spending pool. There are also questions over how many of those already studying in the UK may have travelled home early, leaving landlords exposed to unpaid rents or vacant properties. Some universities actively encouraged international students to return home. In this Briefing Note we address the question of which areas are most exposed to a fall in overseas students. We interrogated Dataloft Rental Market Analytics (DRMA), Dataloft’s rent paid and tenant demographic dataset, to identify overseas students, review distribution patterns and analyse rental premiums. The DRMA dataset incorporates the private rental sector including build to rent.

What does the evidence say?

In the UK there are around 450,000 full-time overseas students and we estimate that at least 130,000 overseas students live in the private rental sector.

14% of overseas students with lease expiries in August and September 2020 are from China, and 6% from each of USA, France and Germany – some of the countries worst affected by Coronavirus.

There are significant regional variations in the proportion of overseas students renting privately. In Greater London, we estimate that 20% of students renting privately are from overseas, making this the most exposed market to any reduction in numbers next year, or defaults in the current academic year.

Leeds, Manchester and Nottingham are next most exposed cities with 13% of students renting privately from overseas. Bristol, Portsmouth and Newcastle are the least exposed cities with 3% of student renting privately from overseas.

Within London there are variations in the proportion of overseas students between boroughs. Westminster and the City of London have more than 30% of students privately renting from overseas.

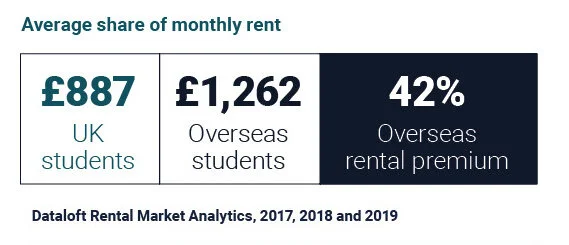

Overseas students in the private rental sector spend more on rent than UK students. In London overseas students spend 42% more on rent than UK students, therefore, higher value rental properties could be worse affected by Covid-19.

Overseas students as %

of all students,

by borough

Greater London private rental sector

Overseas students as % of all students, by city

Risks and opportunities

It looks as though landlords in London are more exposed to the loss of overseas students. However, with lockdown relaxed and the UK borders open, it may be that that some normality will return by September. Either way, students are likely to delay decisions to see how the pandemic progresses and whether travel restrictions are permanently lifted.

Overseas students pay a premium for environments that provide additional security such as 24-hour concierge and on-site facilities that avoid unnecessary travel. The UK has an enduring appeal for overseas students and investors should focus on providing a product that addresses their concerns.

Often in periods of uncertainty student numbers increase as people take the opportunity to upskill or delay entering an increasingly competitive labour market. With many graduate schemes cancelled for summer 2020, this may lead to an increase in the numbers signing up for post graduate courses.

Those students who planned to take a pre-university gap year, with deferred university places, may opt to go straight to university due to limitations on travel plans. So an increase in the number of UK students could offset some of the loss. Universities will need to work to overcome the perfect storm of Covid-19, risk of teething problems with the new Brexit immigration system and the risk that EU students won’t want to pay same fees as non-EU students.

Briefing notes in this series

Issue 1: Short term loss of rental income – how vulnerable are UK cities?

Issue 2: Short term fall in earnings – how vulnerable are UK rental markets?

Issue 3: Short term loss of overseas students – how vulnerable are UK rental markets?

Issue 4: Open market rental values – what happened to values in London at the height of lockdown?

Issue 5: Vulnerable employment sectors – which residential rental markets are most exposed to an increase in unemployment?

Issue 6: Single family housing – exploring the opportunity in UK rental markets.

Issue 7: Moving renters – how long do renters stay in their homes?

Issue 8: Community – How important is community to renters?

Issue 9: Eco-Step Scores – Measuring biodiversity in urban areas

Issue 10: Rental potential –Using affordability to assess headroom for rents